Low mortgage rates continues to serve as an incentive for future buyers.

Real estate statistics released by the Genesee Region Real Estate Information Services (GENRIS), the information subsidiary of the Greater Rochester Association of REALTORS® (GRAR) revealed a third quarter slowdown in residential sales. GRAR officials state that the decline was expected when compared to the second quarter surge, which was bolstered by buyers who needed to close on their tax credit purchases before the June 30 deadline.

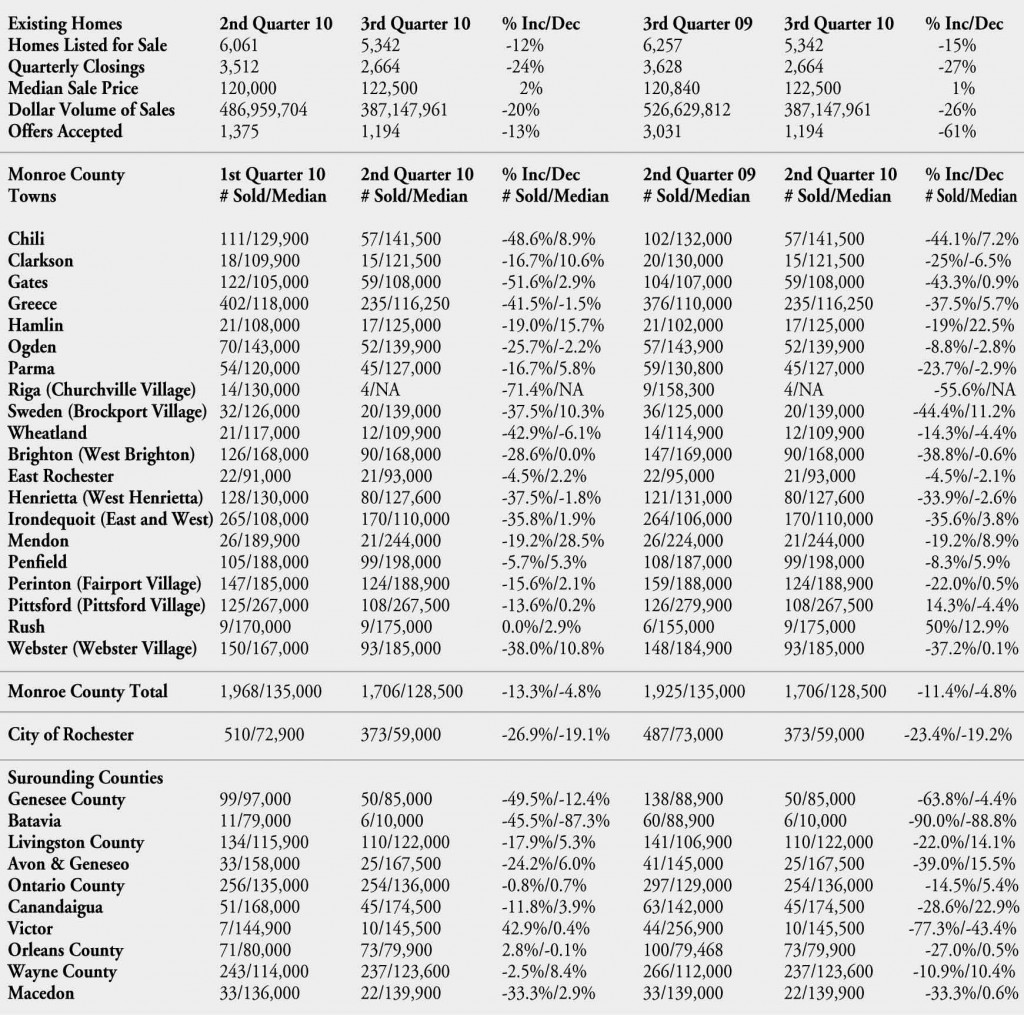

GRAR reported a 24 percent decrease in sales when compared to second quarter 2010, with a total of 2,664 homes sold. The overall median sale price of $122,500 reflected a 2 percent increase compared to last quarter and a 1 percent increase over third quarter 2009. Pending sales were also down 13 percent over last quarter. A sale is listed as pending when the contract has been signed but the transaction has not closed, though the sale usually is finalized within one or two months of signing.

“The tax credit gave our housing market a much-needed „shot in the arm‟ in the first half of the year,” stated Carolyn Stiffler, GRAR board president. “What it also did was alter the timing of purchases because buyers wanted to take advantage of the tax credit opportunity. That, of course, contributed to fewer sales.”

Ryan Tucholski, GRAR chief executive officer stated that REALTORS® continue to remain optimistic about future home sales because of the current low mortgage interest rates and the availability of homes for sale.

“We will continue to market the advantages of homeownership,” stated Tucholski. “We know that there will always be people who are in need of homes. Rochester has always been and continues have a very affordable and stable real estate market,” he continued. This is still a great TIME2BUY.”

GRAR will continue to support the local residential real estate industry through its TIME2BUY marketing campaign, which focuses on the benefits of owning a home and using the services of a REALTOR® when buying and selling a home.