By Gini Denninger

Archive for the ‘Real Estate’ Category

Foreclosures – Build Your Team First!

Wednesday, September 19th, 2012I Was You! Or Maybe You Were Smarter Than This.

Wednesday, September 19th, 2012Buyers Beware (Sellers too)

Wednesday, September 19th, 2012Latest Foreclosure Menace: Sharpie Parties

Saturday, August 25th, 2012As Alex reported 8/25/2012 on Property Source Radio.

Realtor.org – Daily Real Estate News | MON, AUG 20, 2012

News Sponsored by Abodey.com

———————————————————————————————–—–

Young people are connecting across social networks to start “Sharpie parties” that target foreclosed homes and use Sharpie permanent markers to leave a trail of markings behind on the vacant homes.

Merced County, Calif., officials recently reported six Sharpie parties at foreclosed homes that were spawned from invitations posted online. Partygoers—sometimes up to 100 people—are given Sharpie pens and encouraged to write on and graffiti the walls of the abandoned homes. Some of the partygoers, besides marking up the walls, also smash holes in the walls and rip up the floors, Reuters reports.

These parties have also been reported recently in Texas, Florida, and Utah.

Investigators say vandals are leaving a trail on social networking sites, like Facebook, by posting invitations and photos of the parties that are making it easier to find perpetrators. Banks, on the other hand, have been somewhat reluctant to pursue vandals because they don’t want the unwanted publicity to incite more parties, Reuters reports.

As such, “usually they leave the damage and just drop the price,” Andy Krotic, a California real estate professional, told Reuters.

Source: “Sharpie Parties Fuel Rampage on Foreclosed Homes,” Reuters (Aug. 16, 2012)

Not Every Distressed Property Is a Bargain

Saturday, August 11th, 2012As Alex reported 8/11/2012 on Property Source Radio.

Realtor.org – Daily Real Estate News | Tuesday, Aug 7, 2012

News Sponsored by WNYopenhouse.com

———————————————————————————————–—–

Foreclosures can offer some home buyers big bargains, with the typical discount on a foreclosure about 19 percent, according to National Association of REALTORS® data from May. But buyers should be careful not to be guided by price alone, housing experts warn.

“Distressed properties can have great appeal,” says Wendy Forsythe, executive vice president at Atlantic Pacific Real Estate. “Discounted prices and historically low interest rates make these homes affordable to many families who might otherwise not be able to buy a property. But buyers also need to be selective because not every distressed property is a bargain.”

Home buyers need to be aware of some of the following issues with foreclosures before they buy, according to Atlantic Pacific Real Estate, a real estate brokerage with offices in 22 states:

1. Know the claims on the property. How many lenders have claims against the property? “If a distressed home has been financed with two or more loans then the sales process can be far more complex,” according to an article for RISMedia written by Atlantic Pacific Real Estate.

2. Get financing in order. How does the buyer plan to finance the purchase of the property? “Buyers who use financing must prepare in advance so they can act quickly when a distressed property becomes available as there are often multiple bids on an individual home,” according to Atlantic Pacific Real Estate.

3. Judge the condition. Buyers need to carefully weigh the condition of the property. Some foreclosures require extensive and expensive work, and some buyers may find themselves getting in over their head, if they aren’t careful and don’t have a thorough home inspection done of the property prior.

4. Check for potential delays. For example, is the property already occupied? If so, an eviction may be needed and this could delay the purchase process. Buyers need to be prepared for any potential delays.

Source: “Buying a Distressed Home: What You Need to Know,” RISMedia (July 15, 2012)

Rochester’s Quiet Jewel – The Maplewood Neighborhood

Wednesday, August 8th, 2012By Gini Denninger

Thinking about popular neighborhoods in Rochester; Park Ave, Upper Monroe, Corn Hill and the South Wedge come to mind. They are trendy, have lots of stores and restaurants, strong neighborhood associations, and offer a vast variety of home styles. But, did you know there is one neighborhood that offers all of that and more? Located in the North-West side of the city is The Maplewood Neighborhood. This area has been horribly overlooked and additionally, the shrinking of Kodak has not helped. Yet, a revival seems on the horizon for this part of Rochester. People are beginning to remember or uncover the neighborhood for the jewel of the city that it is. More homes are being restored and new businesses are becoming established.

Bounded by the Genesee River as a natural boundary on the east side, Driving Park is the southern boundary, Mt. Read Boulevard on the west and the Riverside and Holy Sepulchre cemeteries’ on the north. In this area you will find some of the most interesting architecture in the city, from small, simple homes to grand mansions, this neighborhood offers huge variety. There are three full size grocery stores within a two mile radius and many small “mom & pop” stores and national chain convenience stores, some with gas stations. Varied restaurants are pocketed throughout the neighborhood. Besides city schools, Nazareth Academy and Aquinas Institute are also found here. There are numerous beautiful churches and Rochester’s only cathedral, the magnificent Sacred Heart Cathedral. A newly refurbished YMCA serves the community and there are even three large parks!

With all this one would think Maplewood would be the premier area to live. Unfortunately negative publicity began to overshadow the positive points of the area. There are down-trodden pockets, some of which are sadly associated with violence, noise and crime. Sadly, this negative image is what sticks in many peoples minds when thinking about the North-West side of Rochester, including the Maplewood area. What people do not know is that most of the streets here are actually quiet neighborhoods!

At this point, I must make a disclosure. I have lived in the Maplewood neighborhood for the past eight years. As a displaced east-sider, I shared many of these misconceptions. I came here because I bought an incredible bargain, a shell of an elegant Queen Anne Victorian. It had good bones and I thought I would restore and flip it. Yet I am still here, because I discovered what a gem of a neighborhood I live in! My greatly restored home is beautiful, roomy and relatively inexpensive! Add into the equation, where else can I find this quality home for the price? I stayed put, and am continually discovering more reasons the Maplewood Neighborhood is the quiet jewel of Rochester. I no longer wonder why the area has such loyal residents, some even are starting to move back in, after leaving for various reasons.

Why love living here? First, and foremost, housing prices immediately come to mind. In this area you get more for your money! Most of the old homes were built on a larger scale. While many have been converted to multi-families, there are still large numbers of single family homes that are unscathed by the frenzy to chop grand old homes up into apartments; so, so many years ago. These homes, invested with quality materials, were a cut above in quality to many other homes in the Rochester area. Lots are generally large and often planted with ornamental trees and shrubs. Inside, find chestnut instead of gumwood for trim, doors, and moldings. Leaded and stained (often quite intricate) glass windows are commonly found. Homes range in design from Victorians, Italianate, Colonial Revival, Craftsman, Prairie, Mission, and many other styles. Rare is the street with cookie cutter homes in Maplewood.

Single family home prices are ranging from $24,000 to $119,000. The average family home sold in the last year is 2500 sq.ft and cost $60-65,000. 2-4 family homes currently on the market range from $40,000 through $120,000. Two real estate firms operate in Maplewood. They are Platinum Properties and Goodman Realty. Vince Nebbia, a Realtor with 25 years experience opened Platinum Properties at the corner of Flower City Park and Lake over seven years ago, growing it to a full service Realty which also offers property management services. Vince chose to live and work in the Maplewood area because it “is a beautiful part of the city and offers so many unique and beautiful homes”. He saw opportunity in a neighborhood with potential to rebound. Another thriving Maplewood Realtor is Sam Morreale, who had the most real estate deals in the area in the last year. Besides working here, he lives here. Sales in the area have been steady. Ask any Realtor that knows the area and they are all likely to agree that single family home prices are currently the lowest they have been in a year, combine this with low interest rates, this is the time to buy into the Maplewood Neighborhood!!!

When people ask what brings a neighborhood back, I tell them several factors come into play. Some of the biggies are properties with unique features making them interesting. A perception of having lots of value for the dollar, even when factoring in property improvements. There must be business infrastructure in place servicing those in the area and providing space for new businesses to come in. The neighborhood has to be easily reached by expressways and major arteries of the city. And preferably there should be unique neighborhood features not found in other parts of the city. Lastly, there should be a strong neighborhood association like the Maplewood Neighborhood Association. The Maplewood area boasts all of the above.

In addition, there are special features many are blissfully unaware of. Did you know that the Maplewood Area is listed on the National Register of Historic Places, as of 1997? Or, that there is a world-famous Rose Garden on the corner of Lake and Driving Park, with thousands of rose bushes lovingly tended by the garden staff. You can attend the

yearly Maplewood Rose Festival in June, when the roses are at their peak. This two day festival has vendors, workshops on growing roses and lots more! Holding weddings here has become very popular! The gardens are next to the Genesee River Gorge, where a trail runs alongside ending at Lake Ontario. It’s very scenic and equivalent to Letchworth Gorge in many ways. Yet most Rochestarians have no idea that they live, play or work near this natural wonder. Stand on the Driving park bridge and enjoy awe-inspiring views. On one side you can see the depth and length of the gorge, on the other side; the falls. The “upper” and “lower” falls are visible from the bridge. Walk down the path by the newly refurbished YMCA and you can stand right next to the “lower falls”, feel the ground rumbling from tons of water rushing by and get wet from its spay. After that, meander a path under the Driving Park Bridge to the Maplewood Park and back to the Rose Garden or continue on the trail to Lake Ontario. The Maplewood Park was famously designed by Olmstead. It is one of the most serene parks in the city.

Love looking at houses? Take a walk to see the many styles. By Nazareth Academy is 1017 Lake Ave, one of the earliest surviving homes in the Maplewood historic district. Further north enjoy the Vanderbeck House at 1295 Lake Avenue. This home is featured on this years Maplewood House and Garden Tour. Its owner John Acker, bought the property after it suffered extensive damage due to a lightning strike. He had always loved the house and when the opportunity came to put it back to it’s former glory, he jumped at the opportunity. His firm “Cam Real Estate Development“, has beautifully restored the house to it’s former glory, housing John’s office and four apartments. If you love Queen Anne homes, stroll down Lakeview Park. There are many examples of this style here, some rival the painted ladies of San Francisco. Seneca Parkway is known for the many Tudor Revival style homes gracing that street. If you like Bauhaus inspired buildings, check out the apartments at 1043-1059 Lake Avenue. Further north are the famous Thistle Apartments at Lake and Seneca Parkway. This building is a rare example of a Tudor Revival apartment building. These mentioned homes and buildings are just a small sample of what the Maplewood neighborhood has to offer. Its time you get acquainted with Rochester’s Quiet Jewel! Who knows, you might just find your own private jewel, like I found mine!

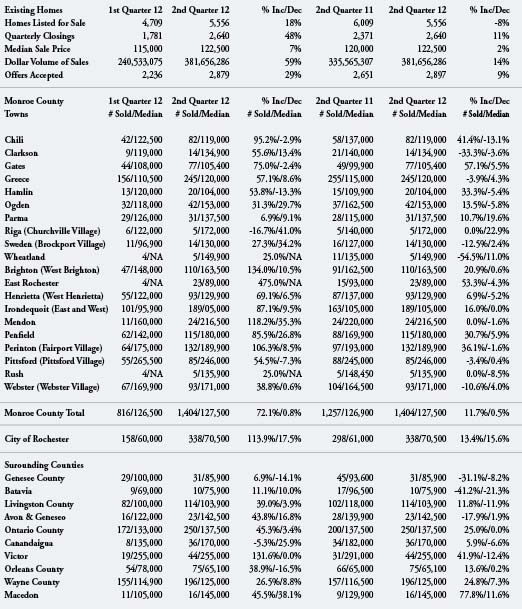

GRAR® 2nd Quarter Statistics

Friday, July 20th, 2012Second Quarter statistics released by the Genesee Region Real Estate Information Services (GENRIS), the information subsidiary of the Greater Rochester Association of REALTORS® (GRAR), indicate that despite a decrease in sales, owning a home in the local region continues to be a wise investment.

Transactions for the Second Quarter 2012 showed a 25 percent decrease over Second Quarter 2011, with 2,640 homes sold, as compared to 3,512 during the same period last year. The number of homes listed dropped by 8 percent from the same quarter last year. The Median sale price was up 2 percent to $122,500.

“Although closings were down during the Second Quarter, as compared to the same period last year, inventories are also down and with many reports of multiple offers, we’re seeing glimpses of a shift to a seller’s market locally,” said Steve Babbitt, president of the GRAR Board of Directors.

Housing data-analysis firm CoreLogic reports that fewer homes on the market guard against a downturn in prices, as seen during the middle of 2010 and 2011. GRAR CEO, James Yockel added, “The housing recovery is ongoing, but appears to be happening in stages rather than a steady climb.”

This past quarter also showed a modest increase in property values from the Second Quarter 2011, instilling that purchasing a home in the Greater Rochester and Finger Lakes region continues to be a great investment.

“With a 109 percent increase in pending sales compared to the same time a year ago, we project a robust impending Third Quarter,” said Babbitt.

Most Monroe County towns and villages showed an jump in median home prices year over year, with the greatest gains in Gates, up 57.1 percent to $105,400 and East Rochester, up 53.3 percent to $89,900. The Finger Lakes region saw similar results with the counties of Ontario and Wayne posting 25 percent and 39 percent gains, respectively.

“The housing market’s recovery is encouraging, even though mortgage lending and down-payment requirements continue to be a challenge. The local economy is gradually improving, interest rates remain low and affordability is at an all-time high,” Babbitt said.

GRAR continues to support the local residential real estate industry by promoting the benefits of home ownership and using the services of a REALTOR® when buying and selling a home.

The GRAR® represents more than 2,600 real estate professionals in the Greater Rochester & Finger Lakes region.

Short Sales: A Sign of the Times

Tuesday, July 10th, 2012By Gini Denninger

The term “Short Sale” was relatively unknown before the financial melt down changed the real estate world. Always around, short sales were much less visible years ago. Over the past five years, extreme economic factors converged, bringing short sales into the limelight. Sellers learned short sales are valuable tools when they need to sell their homes but are unable to get as much or more, than what they owe on the property. Buyers are aware of and interested in finding short sale deals. More agents are short sale experienced. And lenders now opt to work with short sales rather than resorting to foreclosure. The increased use of short sale options has been noticed. It seems everyone is talking about short sales and the opportunity for buyers and, yes, sellers!

We hear of short sales and foreclosures all over the country, but what about here in the Rochester area? Are we affected too? It turns out we are, but not to the degree that other areas are. There are reasons for this. In real estate, the story is always local. Despite the fact that large cornerstone businesses like Kodak, Xerox and Bausch & Lomb downsized, our real estate market stayed relatively stable, except in some areas and for some types of properties like investment properties in the City of Rochester.

Investment properties are one area of real estate especially hard hit with short sales. 2-20 unit investment properties are the most commonly sold as short sales. A combination of unsound leveraging schemes, poor property management and City of Rochester code enforcement issues, creates the perfect storm involving investors. They begin divesting their properties leading to more investment properties available than buyers. Too many properties on the market combined with deferred maintenance on many of these properties, pushes property prices down further. When this happens, the only options can be short sale or foreclosure, depending on the condition and value of the property.

Our suburban areas also offer short sale properties in all price ranges. One of my clients, Robin, bought a Perinton property in the Blackcross neighborhood for $60,000 less than what other properties in the neighborhood were selling at. The owners had fallen on hard times due to divorce and job loss. They no longer were able to maintain the property, letting repairs pile up. Sales appeal was lost in comparison to what was available in the area, forcing the property to be priced ever lower, in an effort to find a buyer willing to put money into the property to bring it back up to neighborhood standards. Robin has greatly improved the property and if she needed to sell, would have no trouble doing so. These buys are out there, but be warned, difficult to find.

Bob Hibbard, a short sale specialist real estate salesperson in the Rochester area points out short sales have to be priced right to sell. If too high, no offers come in. If too low, the bank might not approve the deal. Some people think “short sale” means fire sale. Not so fast! Hibbard says the average discount for a short sale is between 20-30%. This is proven, by the price paid by my client Robin. She should be able to sell between $170-180,000. Short sales might be priced slightly under current market value, which makes them hard to spot. The owners try to get as much as they can to the property to ensure bank approval of the short sale.

Just because someone is willing to make an offer, there is no guarantee the bank will approve the price for a short sale, for various reasons. An appraisal might show more value to the property in question, despite the fact that it has been on the market for an extended period of time and had multiple price drops before the offer came in. The bank may be willing to wait for a better offer to come along, which does happen, depending on the property and its desirability. Desirable neighborhoods, especially higher end suburban areas usually have smaller discount margins than less appealing neighborhoods.

Short sales are a long process. Buyers have to be willing to wait out the process. Robin put her offer in and had to wait for bank approval. Fortunately for her, a previous buyer had begun the process, but was unable to complete their deal. Robins accepted offer was able to be inserted into that buyers place, shortening the wait time by three months. The average short sale takes between 4-6 months from start to finish. But be warned some take longer, even over a year! If the price is right and a buyer is able to wait they will get a great value for the price.

Why would a bank even agree to a short sale? Mike Smith, a Nothnagle Realtor specializing in short sales explains that in NY State, the foreclosure process is very difficult and drawn out. The time it takes to foreclose is double that what it was a few years ago! Before accepting a short sale offer, the bank will calculate what it will cost to complete the foreclosure and what the property could sell for if foreclosed on, in addition to fees for the sale and maintenance of the property. If the sum is more profitable to hold they will hold, foreclose and sell the property themselves. If they calculate they will benefit more by selling as short sale, they will usually opt for the short sale.

Sellers chose to do short sales once they recognize this is a way out of a property they cannot hold on to any longer. Sadly, many who are upside-down with their mortgages do not realize selling their home as a short sale could be an option to them. They think their only option is foreclosure. Hopefully they learn that short sales are an option before losing their homes. Short sales are far less injurious to a persons credit history than foreclosure. Foreclosures take 200 points off credit scores, while short sales only 50. Also, foreclosure must be admitted by a former owner every time they apply for credit or mortgage. Hibbard, points out that short sale sellers can even buy another home in two years while those who opted for foreclosure, wait five years or more.

Short sales arise from sellers need as well as the buyers and lenders recognition of benefits to themselves when party to such sales. Short sales are not without pitfalls, but as long as they continue to benefit all parties involved, they will become more accepted as part of the real estate landscape. The term “Short Sale” will no longer have strong negative connotations and will become just another tool in the selling of property. Selling as a short sale helps those who are genuinely in financial distress, benefits the banks in that they have less foreclosures and is a boon to buyers like my client Robin, who was able to afford a home in Perinton, that she might normally not have considered. Short sales, while difficult and uncertain are a great way to buy a property in our area as well as nationally.

Vacation-Home Buyers are Back

Saturday, June 23rd, 2012As Alex reported 6/23/2012 on Property Source Radio.

Realtor.org – Daily Real Estate News | Tues June 19, 2012

News Sponsored by WNYopenhouse.com

———————————————————————————————–—–

Real estate practitioners in vacation spots across the country say the market for second homes is picking up steam as buyers grow more confident given signs of growth in small businesses.

The National Association of REALTORS® reports a 7 percent jump in vacation sales to 502,000 last year, accounting for 11 percent of all volume. The median vacation home price was $121,000 last year, down from a peak of $204,100 in 2005, but agents in some locales say prices are beginning to creep up as the distressed inventory is moved out.

Vacation-home buyers are snapping up higher-priced properties, although Jennifer Calenda of Michael Saunders & Co. in Southwest Florida says prices are not necessarily on the rise. With inventory hitting a seven-year low of 4.7 months in Sarasota, Manatee, and Charlotte counties, she says buyers “are saying ‘we better hurry up.’”

Inventory is so scarce in some markets that some real estate professionals report multiple offers; and with prices probably at the bottom, Trulia economist Jed Kolko says people ready to make a cash purchase or who can qualify for low mortgage rates should strongly consider buying now.

Source: “Vacation Home Buyers Return, Pick Pricier Properties,” Investor’s Business Daily (06/15/12)

Check our local Waterfront Listings on Property Source!

All Bets Are Off–In Six Months…Who Knows…But now!!!

Wednesday, June 13th, 2012By Rich Levin

It’s an election year. Have you noticed? Rumor has it that if Obama wins one set of things will happen and if Romney wins a different set of things will happen. Either way, it feels like things will change. Let’s all hope for the better. Although for home Buyers it won’t get any better than it is right now. For home Sellers better means that they will get more for their homes. This is good for Sellers. Better means that interest rates will rise. This is good for the mortgage lenders. But for the Buyers soft prices and low rates, the signs of this struggling economy make this the best time to buy.

And Buyers know it. They are out in the market. Houses are selling faster although not necessarily for more money. In some price ranges Buyers are competing for houses; bidding prices higher. In the next price range, just $10,000 or $20,000 higher or lower houses are languishing on the market with little activity.

“This is the type of Real Estate market that two years from now everybody is going to say, “I wish I had bought then.”

Financing

Interest rates are remaining around or below 4% on residential mortgage loans. Mortgage money is available with five percent down or less. The Buyers do need to have steady employment, and a reasonable credit rating. The days of Buyers needing to prove employment, have some cash on hand and credit worthiness have returned.

Requiring stability of employment, credit and some cash is not the banks being cautious. It is the way lenders have made decisions since paper money was invented. Bottom line, solid Buyers can get the best rates and buy at what I believe is at or near the bottom of the market.

Inventory, Foreclosures & Pricing

Foreclosure properties are being purchased at a much higher rate as first time home Buyers and investors in market after market are deciding that we are near enough to bottom.

This Buyer and investor activity will create its own momentum. As more Buyers and investors choose to buy the demand they create will stabilize and lead to market appreciation.

As Real Estate Agents you need to decide if you are comfortable recommending that this is the time for Buyers to buy, that prices may be at or near the bottom. I suggest that we are at or near the bottom and the Buyers you encourage to buy over the next few months will be forever grateful for your advice.

Some Considerations

The Real Estate market, specifically for residential homes is typically not a speculative market. The vast majority of people buy a house to live in it as their home, not to resell it for a profit. Over the last forty years Buyers have come to expect that their home will build equity and appreciate in value. But, the decision to buy is usually based on factors other than anticipated appreciation. Buyers want to own the space in which they live. The fact that this is a fabulous time to make that decision just makes the decision easier.

There is a continuous demand in most markets. People graduate from school, get better jobs, get married and divorced, have children, upgrade and downsize, among dozens of other reasons that new Buyers come on the market. These life events keep occurring. However over the past few years many Buyers have paused. They still want to buy but they are waiting. Historically when there is a time that Buyers are reluctant to buy for any reason this creates a pent up demand.

As Buyers realize that it is a good time to buy but not necessarily for Sellers to sell; demand will begin to absorb and exceed supply. Over the next year or two the additional demand is likely to lead to a Seller’s market. Because of the severity and magnitude of the current housing supply this turn to a Seller’s market will likely be gradual.

Inflation: The X Factor

I remember a rapidly inflationary period. I remember it for a funny reason. I used to drink a lot of Coca Cola. One day when I put a quarter into the machine to vend my Coke I realized that it was going to cost me forty cents. Soon after that it was fifty cents and within five years it was seventy five cents. Now it is at least a dollar. This is inflation. Your money buys less and the cost of what you buy increases.

If you owned Real Estate during this same period you were very happy because the property you owned in 1981 also doubled in price or more by 1986. That is true even if you didn’t live in a highly populated area. This inflationary period did not discriminate by locale.

Are we on the verge of another inflationary surge? I don’t know. I have been reading what I can find on this and it seems to be a largely ignored topic. The people in our government and financial institutions openly talk about having little control. I think about the trillions of dollars worldwide being spent on bailouts. The definition of inflation is when the amount of money in circulation increases and the available goods decreases. It seems to me that is what is happening.

If inflation does devalue our money then house prices, along with the price of almost all other hard goods will increase and this year’s Buyers are going to get benefit tremendously.

First Time Buyers and Investors

FIRST TIME BUYERS THIS IS YOUR TIME!

Another group that I am encouraging to buy now is investors of residential rental property. Investors still have to do their investment analysis. They still have to carefully look at occupancy and vacancy rates. In other words, investors have to make smart, calculated buying decisions. This is always the case.

The reason it is a good time for these investors is because the market is soft. Rents are increasing, often by large amounts. As long as there has not been a population exodus in your community, that is, as long as people are choosing to live in your community and employment is stable, the rental property is going to sustain value. At the same time market conditions right now, with more challenging underwriting standards and only those who really need to sell putting their property on the market creates the opportunity all investors are looking for, buy low, particularly those with cash.

Get in the Game

One of my sons just closed on a new home for his family. My other son is getting his Real Estate license because he is seeing so many people around him buying. My Clients are Real Estate Agents all over the country that I coach and teach. Selling multi-million dollar homes in Long Island, Southern California, half-Million dollar homes in thousands of places or sixty thousand dollar homes in rural and urban areas Real Estate Agent are busier than they have been in years. The market is changing. It will not be this good for Buyers forever. Take advantage now, in six months, all bets are off.

Rich Levin is a Real Estate Coach with Clients across North America. For information contact Rich at 585-244-2700 or rich@richlevin.com. Website: www.RichLevin.com