By Gini Denninger

The term “Short Sale” was relatively unknown before the financial melt down changed the real estate world. Always around, short sales were much less visible years ago. Over the past five years, extreme economic factors converged, bringing short sales into the limelight. Sellers learned short sales are valuable tools when they need to sell their homes but are unable to get as much or more, than what they owe on the property. Buyers are aware of and interested in finding short sale deals. More agents are short sale experienced. And lenders now opt to work with short sales rather than resorting to foreclosure. The increased use of short sale options has been noticed. It seems everyone is talking about short sales and the opportunity for buyers and, yes, sellers!

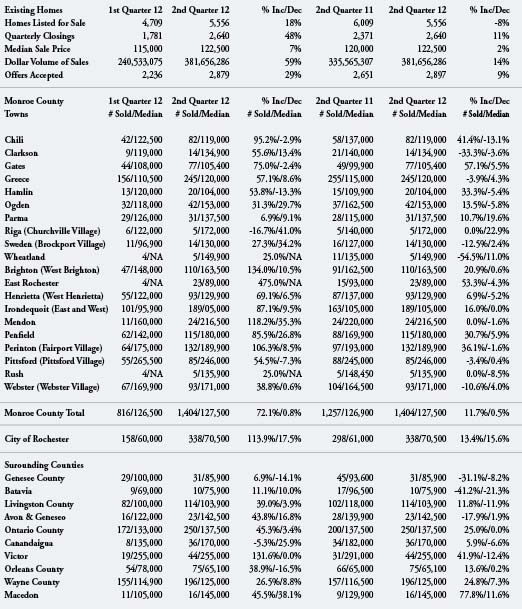

We hear of short sales and foreclosures all over the country, but what about here in the Rochester area? Are we affected too? It turns out we are, but not to the degree that other areas are. There are reasons for this. In real estate, the story is always local. Despite the fact that large cornerstone businesses like Kodak, Xerox and Bausch & Lomb downsized, our real estate market stayed relatively stable, except in some areas and for some types of properties like investment properties in the City of Rochester.

Investment properties are one area of real estate especially hard hit with short sales. 2-20 unit investment properties are the most commonly sold as short sales. A combination of unsound leveraging schemes, poor property management and City of Rochester code enforcement issues, creates the perfect storm involving investors. They begin divesting their properties leading to more investment properties available than buyers. Too many properties on the market combined with deferred maintenance on many of these properties, pushes property prices down further. When this happens, the only options can be short sale or foreclosure, depending on the condition and value of the property.

Our suburban areas also offer short sale properties in all price ranges. One of my clients, Robin, bought a Perinton property in the Blackcross neighborhood for $60,000 less than what other properties in the neighborhood were selling at. The owners had fallen on hard times due to divorce and job loss. They no longer were able to maintain the property, letting repairs pile up. Sales appeal was lost in comparison to what was available in the area, forcing the property to be priced ever lower, in an effort to find a buyer willing to put money into the property to bring it back up to neighborhood standards. Robin has greatly improved the property and if she needed to sell, would have no trouble doing so. These buys are out there, but be warned, difficult to find.

Bob Hibbard, a short sale specialist real estate salesperson in the Rochester area points out short sales have to be priced right to sell. If too high, no offers come in. If too low, the bank might not approve the deal. Some people think “short sale” means fire sale. Not so fast! Hibbard says the average discount for a short sale is between 20-30%. This is proven, by the price paid by my client Robin. She should be able to sell between $170-180,000. Short sales might be priced slightly under current market value, which makes them hard to spot. The owners try to get as much as they can to the property to ensure bank approval of the short sale.

Just because someone is willing to make an offer, there is no guarantee the bank will approve the price for a short sale, for various reasons. An appraisal might show more value to the property in question, despite the fact that it has been on the market for an extended period of time and had multiple price drops before the offer came in. The bank may be willing to wait for a better offer to come along, which does happen, depending on the property and its desirability. Desirable neighborhoods, especially higher end suburban areas usually have smaller discount margins than less appealing neighborhoods.

Short sales are a long process. Buyers have to be willing to wait out the process. Robin put her offer in and had to wait for bank approval. Fortunately for her, a previous buyer had begun the process, but was unable to complete their deal. Robins accepted offer was able to be inserted into that buyers place, shortening the wait time by three months. The average short sale takes between 4-6 months from start to finish. But be warned some take longer, even over a year! If the price is right and a buyer is able to wait they will get a great value for the price.

Why would a bank even agree to a short sale? Mike Smith, a Nothnagle Realtor specializing in short sales explains that in NY State, the foreclosure process is very difficult and drawn out. The time it takes to foreclose is double that what it was a few years ago! Before accepting a short sale offer, the bank will calculate what it will cost to complete the foreclosure and what the property could sell for if foreclosed on, in addition to fees for the sale and maintenance of the property. If the sum is more profitable to hold they will hold, foreclose and sell the property themselves. If they calculate they will benefit more by selling as short sale, they will usually opt for the short sale.

Sellers chose to do short sales once they recognize this is a way out of a property they cannot hold on to any longer. Sadly, many who are upside-down with their mortgages do not realize selling their home as a short sale could be an option to them. They think their only option is foreclosure. Hopefully they learn that short sales are an option before losing their homes. Short sales are far less injurious to a persons credit history than foreclosure. Foreclosures take 200 points off credit scores, while short sales only 50. Also, foreclosure must be admitted by a former owner every time they apply for credit or mortgage. Hibbard, points out that short sale sellers can even buy another home in two years while those who opted for foreclosure, wait five years or more.

Short sales arise from sellers need as well as the buyers and lenders recognition of benefits to themselves when party to such sales. Short sales are not without pitfalls, but as long as they continue to benefit all parties involved, they will become more accepted as part of the real estate landscape. The term “Short Sale” will no longer have strong negative connotations and will become just another tool in the selling of property. Selling as a short sale helps those who are genuinely in financial distress, benefits the banks in that they have less foreclosures and is a boon to buyers like my client Robin, who was able to afford a home in Perinton, that she might normally not have considered. Short sales, while difficult and uncertain are a great way to buy a property in our area as well as nationally.