By Rich Levin

This is the type of Real Estate market that two years from now everybody is going to say, “I wish I had bought then.” All the factors are lining up for the next six to twelve months to be that year. Let’s look at those factors.

Financing

Interest rates are dropping below 6% on residential mortgage loans. Rates are seldom that low and when they have reached that level, mortgage loan rates do not stay there for long. According to HSH Associates, the nation’s largest publisher of consumer loan rates (HSH.com) from mid 2003 through mid 2005 rates hovered just above and below the 6% threshold, never below for more than a few months. Before that they had not been below 6% for forty years. The most likely conclusion is that mortgage loan rates will not stay below six for long. So, Buyers would be wise to be actively looking to buy and take advantage very soon.

Mortgage money is available. Real Estate Agents and mortgage brokers from coast to coast are all telling me that there is money available with five percent down or less. The Buyers do need to have steady employment, and a reasonable credit rating. The days of Buyers needing to prove employment, have some cash on hand and credit worthiness have returned for good, hopefully. Violating those obvious principles contributed enormously to our current global financial crisis.

Requiring stability of employment, credit and some cash is not the banks being cautious. It is the way lenders have made decisions since paper money was invented. The last ten years when those fundamentals were ignored have been the exception. Bottom line, solid Buyers can get the best rates and buy at what I believe is at or near the bottom of the market.

Inventory, Foreclosures and Pricing

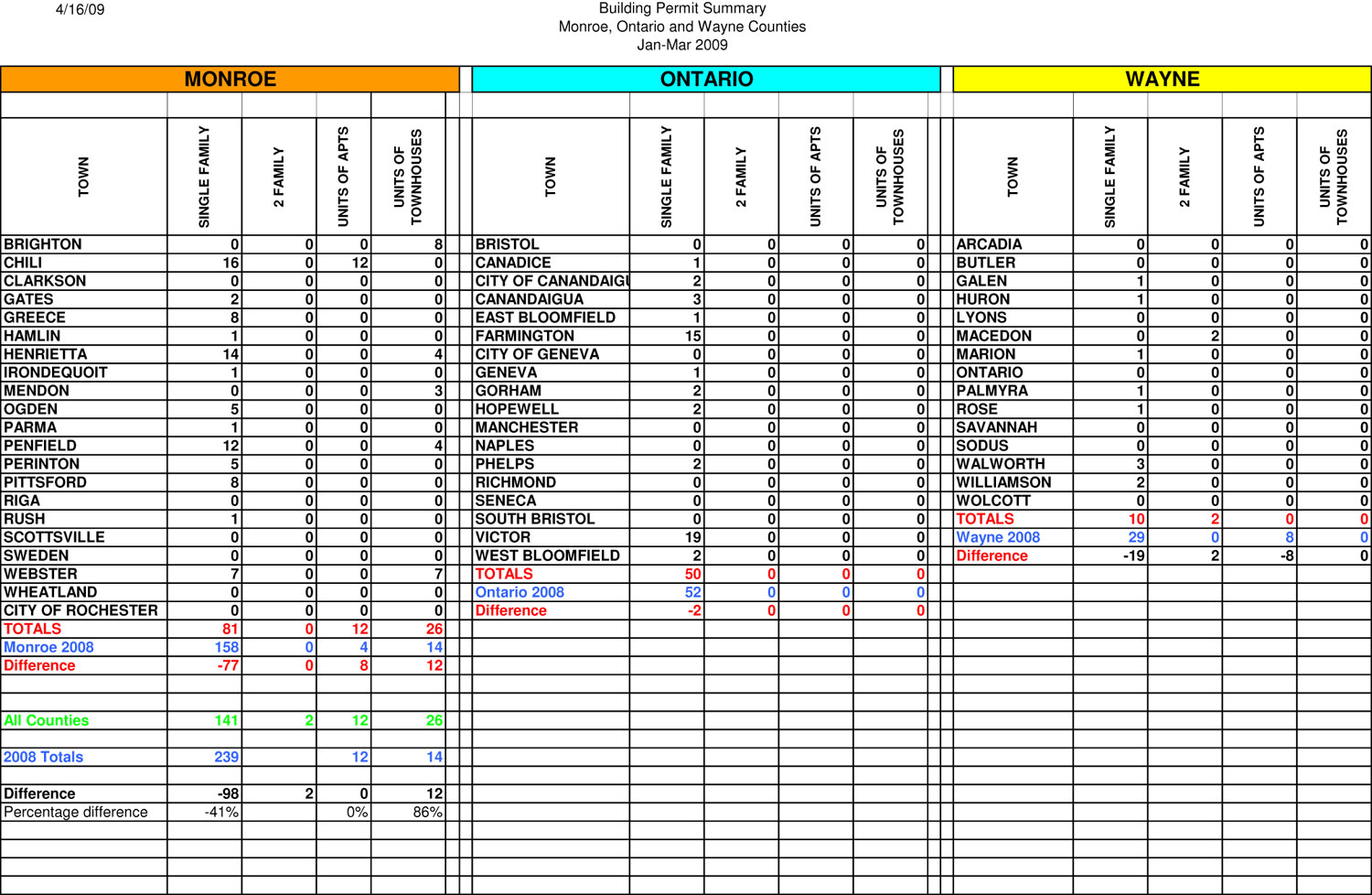

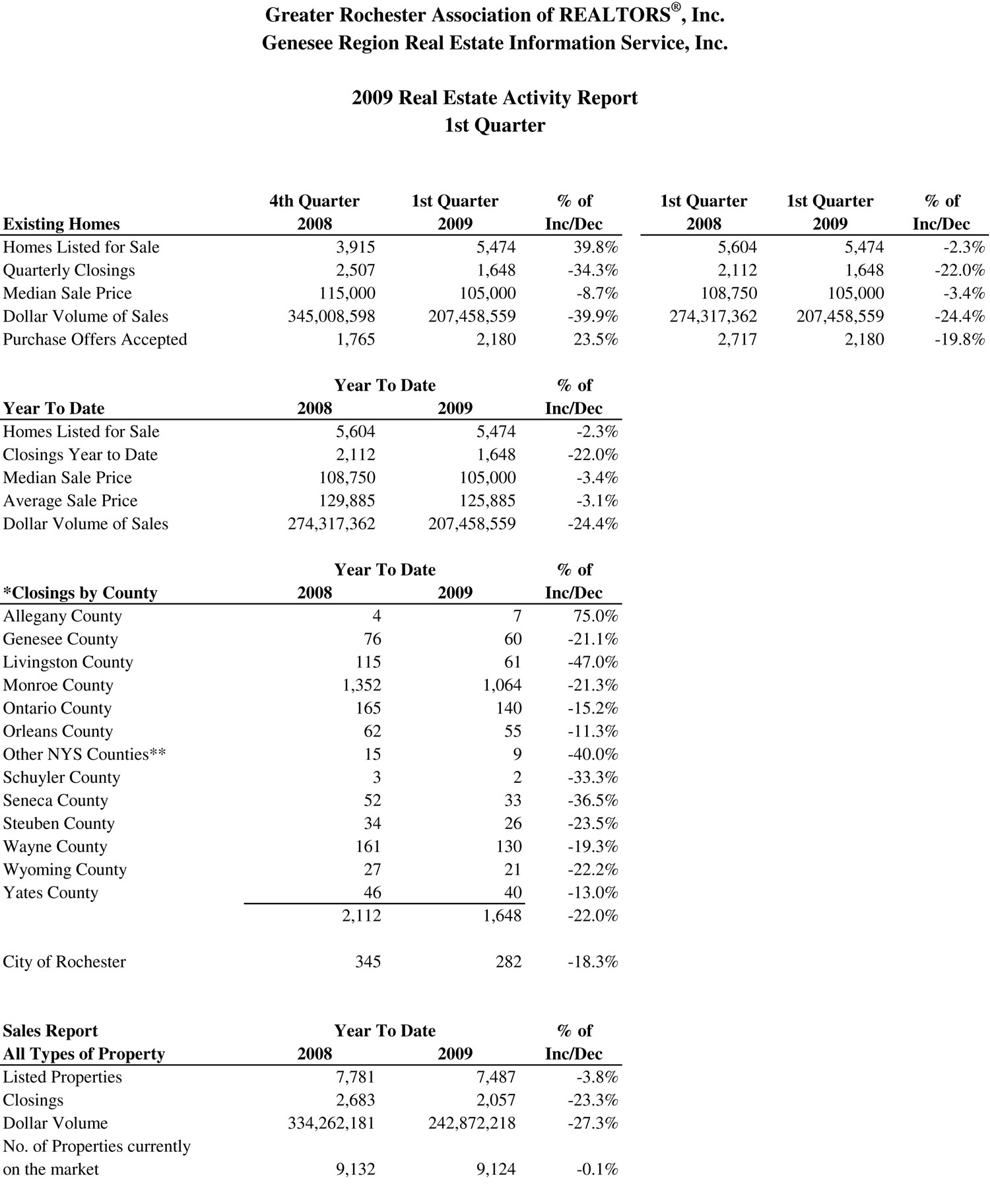

New home inventories are being absorbed. According to HWMarketIntelligence.com “the number of new homes for sale continues to steadily decline and have not recorded a monthly increase since May 2007.” According to the Mortgage Bankers Association the number and rate of properties entering foreclosure is slowing.

My anecdotal research from my Real Estate Agent Clients around the country is that the foreclosure properties are being purchased at a much higher rate as first time home Buyers and investors in market after market are deciding that we are near enough to bottom.

This Buyer and investor activity will create its own momentum. As more Buyers and investors choose to buy now the demand they create will stabilize and lead to market appreciation. Did people who bought at the height of the boom in late 2005 and 2006 lose equity? In most markets yes, in some markets they lost a lot. Are the Buyers who buy over the next year likely to be buying at the bottom of the market and benefit from excellent appreciation? Every indication that I see says yes.

As Real Estate Agents you need to decide if you are comfortable recommending that this is the time for Buyers to buy, that prices may be at or near the bottom. I suggest that we are at or near the bottom and the Buyers you encourage to buy over the next twelve months will be forever grateful for your advice.

Some Considerations

The Real Estate market, specifically for residential homes is typically not a speculative market. The vast majority of people buy a house to live in it as their home, not to resell it for a profit. Over the last forty years Buyers have come to expect that their home will build equity and appreciate in value. But, the decision to buy is usually based on factors other than anticipated appreciation. The Buyers you encourage to buy want to own the space in which they live. The fact that this is a fabulous time to make that decision just makes your job easier.

Second, there is a continuous demand in most markets. People graduate from school, get better jobs, get married and divorced, have children, upgrade and downsize, among dozens of other reasons that new Buyers come on the market. These life events keep occurring. However over the past two years these Buyers have paused. They still want to buy but they are waiting. Historically when there is a time that Buyers are reluctant to buy for any reason this creates a pent up demand.

As Buyers realize that it is a good time to buy but not necessarily for Sellers to sell; demand will begin to absorb and exceed supply. Over the next year or two the additional demand is likely to lead to a Seller’s market. Because of the severity and magnitude of the current housing supply this turn to a Seller’s market will likely be gradual.

The signs of this shift are occurring now, that is, the supply of new construction and foreclosure homes are being absorbed by first time Buyers, investors, and secure homeowners taking advantage of their financial strength. This spring may be the tipping point when market activity flourishes. I believe it will.

Inflation: The X Factor

I remember a rapidly inflationary period. I remember it for a funny reason. I used to drink a lot of Coca Cola. One day when I put a quarter into the machine to vend my Coke I realized that it was going to cost me forty cents. Soon after that it was fifty cents and within five years it was seventy five cents. Now it is at least a dollar. This is inflation. Your money buys less and the cost of what you buy increases.

If you owned Real Estate during this same period you were very happy because the property you owned in 1981 also doubled in price or more by 1986. That is true even if you didn’t live in a highly populated area. This inflationary period did not discriminate by locale.

Are we on the verge of another inflationary surge? I don’t know. I have been reading what I can find on this and it seems to be a largely ignored topic. I notice that gas prices are declining but not much else. I think about the trillions of dollars worldwide being spent on the bailout. The definition of inflation is when the amount of money in circulation increases and the available goods decreases. It seems to me that is what is happening.

If inflation does devalue our money then house prices, along with the price of almost all other hard goods will increase and this year’s Buyers are going to get benefit tremendously. Whether this happens or not it is time for buyers to get in the market.

First Time Buyers and Investors

For certain Buyers it is time to get active. I am saying to anyone and everyone that will listen. FIRST TIME BUYERS THIS IS YOUR TIME! The federal government is still offering a $7,500 tax credit that is scheduled to conclude in the summer of 2009. Prices and interest rates are down. If you are employed and credit worthy you can buy with a small amount of cash out of pocket. FIRST TIME BUYERS THIS IS YOUR TIME!

Another group that I am encouraging to buy now is investors of residential rental property. Investors still have to do their investment analysis. They still have to carefully look at occupancy and vacancy rates. In other words, investors have to make smart, calculated buying decisions. This is always the case.

The reason it is a good time for these investors is because the market is soft. As long as there has not been a population exodus in your community, that is, as long as people are choosing to live in your community and employment is stable, the rental property is going to sustain value. At the same time market conditions right now, with more challenging underwriting standards and only those who really need to sell putting their property on the market creates the opportunity all investors are looking for, buy low, particularly those with some cash.

Get in the Game

So, I have been telling my Agent Clients and my audiences to shout from the rooftops that first time Buyers and investors should get in the game. Call the people in your spheres of influence and your past Clients and be honest with them about whether it is a good time to sell.

At the same time encourage them to tell their relatives, friends and any one that they care about that if they are first time Buyers to call you and start looking. If they are investors with some cash suggest that they start looking for golden opportunities with you.

Look for articles from legitimate sources about what is going on with the global financial crisis. But then look at your local market and discover the opportunities for first time Buyers, investors or any other group or type of property that may be a shining beacon through the fog.

Be the optimistic and intelligent voice of opportunity and you will both survive this market you will become a roaring success as the market improves; which it will. When? For most markets, the prediction is late 2009. For some it will be spring of 2009 and for others it will be longer.

I have led Agents to success in four of these major shifts since 1979. Every one of these soft markets creates strength in those that survive it. And those who survive it by discovering the opportunities for their Clients become the highest producers and the leaders of the healthy market that is likely to be just around the corner.

Rich Levin is a coach and speaker whose focus is teaching Agents to achieve their highest level of production with a better quality of life. Rich is presenting a workshop titled “Survival of the Prepared, Adapting to Changing Markets” at the NAR Convention and in dozens of other Associations, Franchises and Brokers across the country. For Information contact Rich at 585-244-2700 or visit http://www.RichLevin.com.

Ask Rich a question at http://www.AskCoachRichLevin.com