Continuous radio, television and newspaper advertisements tout the advantages of replacing your old, drafty windows with new energy-efficient windows. You can call a company to come to your house tomorrow to tell you the advantages of window replacement and provide you with a quotation. What should you do?

Like any equipment replacement decision, the answer regarding window replacement is not black and white. There are many factors that go into this decision:

• Do I want to replace my windows strictly for energy efficiency?

• How efficient are my windows now?

• Can I improve the efficiency of my existing windows in a cost effective manner?

• Do I want to replace windows for comfort more than energy efficiency?

• Are my windows difficult to maintain?

• Do my windows need a lot of deferred maintenance?

• Am I concerned about lead paint hazards of old windows?

• Do I need new storm windows if I do not replace my windows?

• Are my windows aesthetically pleasing?

• Do my existing windows add to or detract from the value of my home?

• Do I live in a preservation district that restricts types of replacement windows?

Older windows require varying amounts of maintenance and repair, but many can be difficult to replace in terms of their aesthetic appeal

All of the above (and more) can factor into the decision making process. However, there is some hard data that gets lost in the sales pitch that you need to consider.

Existing windows can vary widely in their insulating qualities and energy efficiency. Window qualities to consider from an energy efficiency standpoint include:

• The insulating efficiency, or U-factor

• The “tightness” of the window to stop drafts (infiltration).

• The shading qualities to reduce heat gain.

Since the number of run-hours for air conditioning systems in our region varies widely, and the typical annual cost of air conditioning a home is far less than the heating cost, the first two qualities (U-factor and “tightness”) are the most critical properties. The comparison of existing windows to replacement windows, in terms of energy savings, should focus on the window qualities that affect the cost of heating your home.

For years, many publications, including those from ASHRAE (the American Society of Heating, Refrigeration, and Air Conditioning Engineers) stated that a well-sealed single pane window with a good storm window is just as energy efficient as a standard grade double-pane window. The problem is, most old windows are not well-sealed or well-maintained, and this is also true of the storm window.

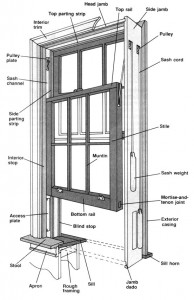

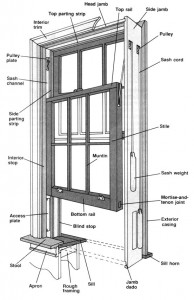

Older, existing windows have many parts, but they can be maintained for many years

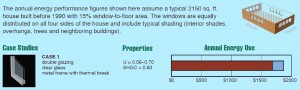

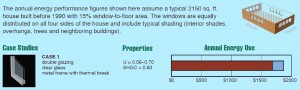

The Efficient Windows Collaborative (www.efficientwindows.org) is an organization of window manufacturers. This organization promotes new windows and the related benefits, along with maintaining industry standards. On their web site, they have a case study for an existing home in Buffalo, NY. Part of the case study is shown below.

The case study basically points out that by going from a “Case 1” lower performing double pane window (which a single pane window with a storm could be considered basically equivalent) to a high-performance “Case 6” window, the house will reduce heating costs by approximately $300 per year. This is for a house that probably has 20 or more windows. The cost to replace that many windows would probably be in the range of at least $8,000 to $15,000 (assuming $400 to $600 per window for 20 to 25 windows). This translates to a simple economic payback of 26 to 50 years!

Proper windows replacement in many homes requires the labor of a skilled contractor

To be fair, there is almost always a cost to bringing the existing windows up to a level of efficiency equivalent to a “Case 1” window. But the cost of that improvement results in immediate corresponding energy savings as well; especially in terms of reducing leakage (infiltration). Caulking, weather stripping, and repair/replacement of storm windows are the costs that should first be evaluated and compared to the costs of window replacement.

Examples of “modern” windows that are good candidates for repair or replacement

Beyond the issue of energy savings, in some cases window replacement can significantly add to the resale value of a home. According to Remodeling Magazine’s annual Cost vs. Value Report, you can recoup more than 75% of the window replacement project cost in added home value. The link to specific Rochester, NY data is: www.remodeling.hw.net/2009/costvsvalue/division/middle-atlantic/city/rochester–ny.aspx

Of course, this is an organization that promotes remodeling and they are publishing financial estimates regarding the great value of such remodeling. The value added is difficult to quantify and will vary widely based on the location of the house, market conditions, the condition of the existing windows, and other factors.

New windows can add significant value to a home, but at a significant cost

As with any home improvement, there are many factors to consider when thinking about replacing or restoring windows. From a strict energy savings standpoint, most window replacements are not justified. However, when energy savings is combined with added value to the home, elimination of lead paint, increased comfort, and other factors, replacement can often be justified.

As always, please do not hesitate to contact our office if we can be of any assistance in this regard, or in regard to other issues related to home inspections.